Events

Publications

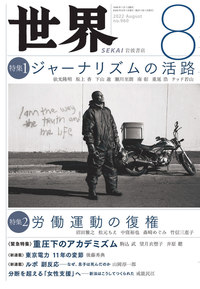

The Resurgence of the American Laobr Union Movement? What It Means Legally to Win an Election, and the Long Way Beyond That [in Japanese]

AbstractThe coronavirus pandemic and the recent price hikes have stimulated union movements in the United States, and labor unions have won representative elections at two renowned companies, Starbucks and Amazon. Using the cases of these two companies as examples, Professor Nakakubo discusses the significance and structure of representative elections from a legal perspective. This article introduces the uniquely American legal system of exclusive bargaining based on majority rule, and then explains the process of union organizing activities, filing for an election, election campaings, and determining the results by cast ballots under this system. In addition, it points out that even when a union wins the election and collective bargaining begins, it may lose its bargaining representative status if a collective agreement is not concluded within a year, and that there is a long way before a union's presence takes root. Although the legal reform is unlikely to be realized and the difficult conditions for unions will continue, Professor Nakakubo suggests that there are signs that the changing times are causing unions to be reevaluated and the future will be interesting to watch.

Bad Debt Losses and Debt Relief: Developments since the Supreme Court Decision in the Case of Industrial Bank of Japan [in Japanese]

AbstractThe article examined examples regarding whether bad debt losses are allowed as deductible expenses under the Corporate Tax Law. Referring to court precedents after the Supreme Court ruling in the case of Industrial Bank of Japan and guidance by the National Tax Agency, the article explained the circumstances on the creditor's side regarding recoverability of debts, special liquidation procedures in debt waiver, and judgments regarding the applicability of charitable deductions.

Judgment of the Tokyo High Court (Jul. 19, 2013) Fair Treatment Standards – The Bic Camera Case [in Japanese]

AbstractAs a decision from the perspective specific to the Corporate Tax Law, this article addresses the significance of the ruling that denied the applicability of the fair treatment standard for the treatment based on the Practical Guideline for Real Estate Liquidity.

Judgment of the Supreme Court (Dec. 24, 2004) The Meaning of Bad Debts – The Case of Industrial Bank of Japan [in Japanese]

AbstractIn recognizing bad debts, regarding whether creditors' unique circumstances and economic conditions can be considered or not, this article addresses the case of Industrial Bank of Japan, which is significant to clarify specific judgment structure.

Gender Equality in the Workplace from a Legal Perspective: Current Situation and Issues of Japan’s Equal Employment Opportunity Act

AbstractThe Equal Employment Opportunity Act (EEOA), the cornerstone of Japan’s gender equality legislation revised in 2006, faces several challenges including wage discrimination, indirect discrimination on the grounds of sex, and disadvantageous treatment by reason of pregnancy and childbirth, etc. In the future, further strengthening of the EEOA should be considered, including stronger legal remedies for violations.

Introduction of market country taxation through revision of international taxation rules [in Japanese]

AbstractThe article introduces a new framework for international taxation reform to appropriately accommodate the activities of multinational corporations that are digitizing their economies. Prof. Yoshimura examines the theories underlying the taxing rights of market countries and the implications these theories have for the local tax debate and its future. While the changes in international taxation rules are not immediately applicable to local taxation systems, it should be considered that the development of information and communication technology requires modifications to the standards on which taxation rights have been based, a point which the two have in common.

A Minimum Corporate Tax Rate―The Overview of the GloBE Rule and Its Challenges [in Japanese]

AbstractThis article provides an overview and outlook of the GloBE rule, a measure to effectively block tax erosion and profit shifting by multinational companies. A minimum corporate rate of 15% will ease tax competition, but will not end it.

Sex Discrimination in Promotion and Its Remedies: The Kanematsu Case [in Japanese]

AbstractConcerning the case in which the plaintiffs claimed the wage disparity between female and male workers with same characteristics and sought the difference in wages, lump-sum payments, compensation, and attorney's fees, the article analyzes the judgment that changed the original verdict and partially approved the claim for damages(Tokyo High Court's judgment on January 31, 2008).

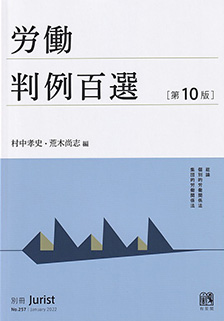

Supreme Court (First Petty Bench) Asahi Building Management Co. v. Doe

AbstractThe journal gathers labor law judgements by the highest courts, and publishes them with headnotes and annotations regarding context on the case.

Researchers

Full-time Researchers

|

|

|

|