The Rise of ESG Investment and Its Controversial Reception in the United States: Implications for Global Governance

Yuki Miyoda

(Specially Appointed Assistant Professor, Graduate School of Law, Hitotsubashi University)

September 27, 2023

Introduction

The concept of ESG (Environment, Social, and Corporate Governance) investments was introduced by the Principles for Responsible Investment (PRI), a United Nations-supported organization, in 2006. ESG investment provides a framework for investors to evaluate a company’s sustainability efforts, with the potential for greater long-term profits by considering risks and opportunities beyond traditional financial models. Factors such as emissions reduction and board diversity are assessed to mitigate risks and achieve better outcomes. Since PRI’s foundation, the term ESG investment has been used to describe the integration of financial and non-financial information and evaluation from a long-term perspective. However, there is a growing divide towards the concept.

Three Factors Behind the Growing Anti-ESG Movement

The criticisms of ESG investment can be attributed to three key factors: the liberal-conservative confrontation, protection of the fossil fuel industry, and the ambiguity of ESG investment itself. The first two factors have been politicized and exploited by Republicans, while the last relates to criticisms regarding the ad-hoc nature of ESG investment.

A. Liberal-Conservative Confrontation

A-1. Historical ESG and Partisan Rivalry in the US

For almost three decades, there has been a swing in regulatory guidance in the United States on whether to include ESG factors in the investment decision process. Republicans argue that ESG restrains short-term profit maximization and therefore harms businesses. This viewpoint has historically hindered the integration of sustainability into business practices. The interpretation of the Employee Retirement Income Security Act (ERISA) of 1974 oversight by the Department of Labor, which guides corporate pension management, has fluctuated depending on the administration’s stance on ESG investment. Consequently, Democrats tend to support ESG, while Republicans lean toward an anti-ESG position. This pattern continues despite the adoption of global accords such as SDGs and the Paris Agreement in 2015, as such accords permit individual countries the flexibility to interpret and implement them as they see fit.

Table 1 The Stance toward ESG in Relation to the Employee Retirement Income Security Act (ERISA) of 1974

| Year | Administration | Types | Stance on ESG |

| 1994 | Clinton (Democrat) | Interpretive Bulletin | Promote |

| 2008 | Bush (Republican) | Interpretive Bulletin | Discourage |

| 2015 | Obama (Democrat) | Interpretive Bulletin | Promote |

| 2018 | Trump (Republican) | Field Assistance Bulletin | Discourage |

| 2020 | Trump (Republican) | Regulation | Discourage |

| 2021 | Biden (Democrat) | Amendment of the above Regulation | Promote |

Source: Okada and Nakamura (2021)

The issue gained national attention when President Biden ultimately vetoed the Republican proposal on preventing the consideration of ESG in investment decisions by retirement plan fiduciaries from being enacted, using his first presidential veto in 2023 March. President Biden pursued an interpretation of ERISA that allows retirement plan fiduciaries to consider all financially relevant factors including ESG in investment decisions. Recent trends go one step further than the previous confrontation.

A-2. Recent Divide in the US

The studies at Pew Research Center over the past few years illustrate the increasingly stark disagreement between Democrats and Republicans on a long list of issues. The center found that “race, religion and ideology now align with partisan identity in ways that they often didn’t in eras when the two parties were relatively heterogenous coalitions.” These issues are far more contentious in the US compared to Japan, leading to heated debates and conflicts between liberals and conservatives. Consequently, when businesses involve themselves in such matters, it is referred to as “Woke Capitalism.” Recent examples include discussions on LGBTQ+ rights, abortion rights, and Diversity, Equity, and Inclusion (DEI).

In May 2022, the Walt Disney Company faced public criticism from its employees opposing Florida’s legislation restricting the teaching of gender identity in schools, and as a result, the company openly condemned such legislation. In response, the Florida government revoked certain economic benefits enjoyed by the company.

Following the Supreme Court’s decision on Dobbs v. Jackson Women’s Health Organization, which overturned the right to abortion, some companies offered to cover transportation expenses for employees seeking reproductive care in states where abortion remains legal. On the other hand, companies directly linked to healthcare, such as pharmacies and drug chains, faced pressure regarding the sale of legal abortion pills.

Moreover, liberal companies have intensified their focus on DEI, with an increase in the number of chief diversity officer roles and the inclusion of diversity metrics in executive compensation. In the aftermath of George Floyd’s murder in 2020, Corporate America publicly committed at least $50 billion to address systemic racism, although the legitimacy and efficacy of these commitments has been subject to debate. Ultimately, this phenomenon serves as a strategic tool for Republicans, enabling them to swiftly express their opposition without resorting to passing anti-liberal laws.

A-3. Shareholder Activism

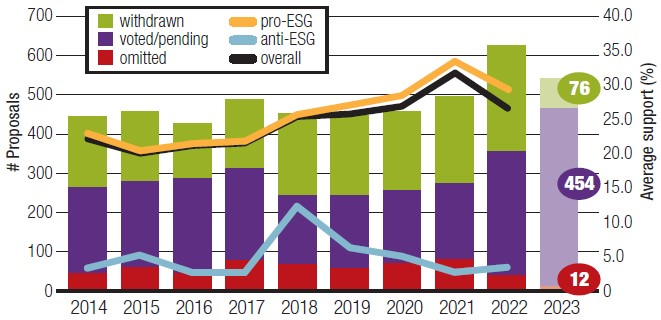

The divide in the US can also be found in the shareholder proposal outcomes. As can be seen from Figure 2, along with pro-ESG, there are also anti-ESG shareholder proposals that aim to discourage companies from implementing greenhouse gas emissions reductions or increasing DEI.

Figure 2 Environmental & Social Policy Shareholder Proposal Outcomes

Source: Proxy Monitor

However, as is obvious in the above table, there is not much support for shareholder proposals with right-wing ideas and therefore, anti-ESG in the market does not stem from market actors but more from political actors. Prominent proponents of these anti-ESG proposals are conservative think tanks, such as the National Center for Public Policy Research and the National Law and Policy Center. Although anti-ESG proposals are becoming more common, they continue to receive low levels of support with a peak of 3.4% in 2022.

A-4. Anti-ESG Regulation

Republican lawmakers are also eager to attack ESG by proposing anti-ESG bills. They argue that ESG criteria, such as climate risks or board diversity, are liberal distractions that harm investors. Some Republican lawmakers question whether ESG metrics go beyond investment managers’ fiduciary duty to provide the best financial returns for their clients. For instance, Florida has implemented measures that prohibit ESG considerations in pension fund management, municipal bond issuance, and state government procurement. Financial institutions doing business with the state are prohibited from using external ratings to evaluate their ESG efforts. These laws deem contracts or agreements with companies, pension funds, insurance companies, or asset managers adhering to ESG-related policies as “unreasonable boycotts” and such arrangements are therefore forbidden. However, the financial industry and liberal states in the US assert that ESG-related factors are crucial considerations, particularly for long-term investments like pensions, and they refute the notion that ESG considerations hinder investors from serving their clients’ interests.

A recent study found that model anti-ESG legislations have been circulated by the American Legislative Exchange Council (ALEC), the Heritage Foundation, and the Heartland Institute, including those affecting pensions, contracts, proxy voting, and financial advisors. There are three models of anti-ESG bills: Energy Discrimination Elimination Act, Boycotts Act, and Free Enterprise and Investments Act.

Table 2: Model anti-ESG Bills

| Energy Discrimination Elimination Act |

|

|

| Boycotts Act |

|

|

| Free Enterprise and Investments Act |

|

|

Source: Pleiades Strategy

Between January 2023 and June of the same year, 165 anti-ESG bills and resolutions were introduced in 37 states in the United States to counter ESG investment criteria[1]. Anti-ESG bills faced opposition from both business groups and politicians. The reason for the limited support for these ant-ESG bills comes from hesitation around potential financial losses. For instance, one of the first states to start anti-ESG bills, Texas, clearly showed that it lost a sufficient amount of money due to the bills.

B. Protection of the Fossil Fuel Industry

B-1. States’ Action toward Protecting Fossil Fuel

The US has taken the lead as the world’s top oil exporter since around 2010, largely due to the surge in shale oil production. Consequently, there has been a concerted effort to safeguard the fossil fuel sector, particularly in states where oil extraction is a key industry. In these regions, the priorities often lean more toward ensuring a reliable energy supply and job preservation rather than focusing on carbon reduction initiatives. To take these states and industries into account, the Inflation Reduction Act (IRA), enacted in the summer of 2022, also underscores this emphasis on job preservation. A recent report highlights how Republican and libertarian groups, some with ties to the fossil fuel industry, fueled the campaign to promote anti-ESG bills in conservative states during 2023.

However, opposition to anti-ESG legislation also surfaced within these states, largely due to financial considerations. In Wyoming, for instance, the state’s top investment official cautioned legislators that large asset managers pulling out could result in a loss exceeding $500 million. Consequently, all three anti-ESG bills introduced in Wyoming failed. Similarly, a bill in Texas faced opposition after the director of a state retirement system estimated it would cost $6 billion over the next decade. This conflict over ESG policies raises the question of who depends on whom more.

B-2. US Climate Change Policy and Its Impact on Global Climate Governance

The current trend of opposition to ESG investments in the United States is expected to continue and influence global climate change governance. Over 99% of peer-reviewed scientific papers published on the topic agree that climate change is primarily caused by burning fossil fuels, and a large portion of such burning of fossil fuel is undertaken in the US. On the other hand, in certain states, the fossil fuel industry holds significant importance, leading to strong incentives to maintain current levels of fossil fuel consumption and even fostering climate change denialism.

The United Nations’ Net-Zero Insurance Alliance (NZIA) has faced opposition from certain Republicans who argue that the organization’s efforts to reduce clients’ carbon emissions might violate antitrust laws. Recently, 23 attorneys general from various US states have expressed concerns that the NZIA’s objectives and mandates could potentially breach federal and state antitrust laws because the insurers’ actions could result in higher costs for insurance products and services.

As a response to this situation, several prominent insurance companies, including AXA of France (former NZIA Chair), Lloyd’s Insurance Association of England, Allianz of Germany, Tokio Marine, MS&AD, and Sompo HD, have chosen to withdraw from the program, reducing the number of member companies from its peak of 30 to the current 11. The remaining insurers in the NZIA, focused on addressing climate change, are now considering relaxing the Alliance’s membership requirements following the recent exodus of members. This includes removing a six-month deadline for members to publish greenhouse gas emissions targets, among other changes aimed at making membership less restrictive.

Consequently, concerns have arisen within the insurance sector about the potential dissipation of unified efforts towards decarbonization and a decline in effectiveness and momentum. Some investment management firms have stopped using the term ESG. It is worth noting that, however, insurance is the only category that has withdrawn from Glasgow Financial Alliance for Net Zero. In addition, despite the resistance to ESG investment due to its growing volume, the Net Zero initiative is gaining momentum among individual companies, such as Apple and Google.

C. Ambiguity of ESG

Another issue is that there is “ambiguity” in ESG. “Ambiguity” means variability and shifts in what is considered an ESG issue.

Fundamentally, the ESG framework has unified a range of topics that were previously addressed independently, providing a comprehensive perspective when making investment choices. This integrated approach is being applied in other areas, including court justice and trade agreements. However, there are apparent trade-offs between different aspects of ESG, such as human rights and environmental concerns. For instance, low-cost goods may conflict with labor rights, and efforts to combat climate change could adversely affect vulnerable communities. When it comes to assessing corporate ESG performance, each of the E, S, and G components is scored and then combined. However, some critics, like Honda and Itoh in 2023, argue that the economic implications of E, S, and G are fundamentally different[2]. And therefore, Economist says ESG should not be aggregated, and investors should propose simplifying the ESG criteria to focus solely on climate change.

In addition to these criticisms, a recent trend triggered another controversy regarding ESG. In Europe, ESG investors have been excluding companies involved in arms production. However, in the wake of the conflict between Russia and Ukraine, some institutional investors (c.f. SEB) have reversed their stance and lifted their previous exclusions on arms production. Further, the EU Taxonomy Regulation, under specific circumstances, now categorizes natural gas and nuclear power generation as sustainable economic activities.

Conclusion

ESG investment has become a subject of controversy due to its “politicization” (p. 81), in Hay’s words, where “what has not previously been the subject of deliberation, decision-making, and human agency becomes its subject.”[3] The conflict surrounding ESG investment in the United States has garnered significant attention and influenced global governance.

A significant portion of the criticism has been directed at the “E” component of ESG, specifically targeting the inclusion of climate change factors in investment choices. The effects of climate change have been wide-ranging, even affecting the Republican Party’s sway over NZIA, a global private-sector initiative. In addition, certain social issues have also faced criticism, notably corporate initiatives aimed at combating anti-LGBTQ+ and, in particular, anti-transgender bias.

The ongoing debate surrounding the rise of ESG investments demonstrates the complex interplay between politics, governance, and ethical values in investing. Going forward, a balance between objective standards and flexible, adaptable approaches may lead to more inclusive and productive discussions.

[1]The word “anti-ESG bills” was defined by Pleiades Strategy. [2]Keiko Honda and Takatoshi Ito. 2023. ESG Toushi no Naritachi, Jissenn to Mirai (ESG Investing: Its History, Practice and Future). Nikkei Shimbun. [3] Hay Colin. 2007. Why We Hate Politics. Cambridge: Polity Press.

Yuki Miyoda is a Specially Appointed Assistant Professor (Junior Fellow) at the Graduate School of Law, Hitotsubashi University. Her research interests include global governance, Sustainable Development Goals (SDGs), and ESG investment. After graduating from Keio University, she started her carrier at the Bank of Tokyo-Mitsubishi UFJ (now MUFG) and thereafter, enrolled in Hitotsubashi University’s School of International and Public Policy. During her doctoral program at Hitotsubashi University’s Graduate School of Law, she interned at the U.S. Department of Agriculture and also worked for the United Nation-supported Principles for Responsible Investment (PRI) Association. After obtaining her Ph.D., she has expanded her research interests into economic security and human rights issues in the supply chain, and the “nexus” of E, S, and G issues. Her goal is to integrate academic insight and practical experience.